The True Cost of Your Aging Receivables

Your customers appreciate flexible payment options, and it’s true that offering credit will likely increase sales. However, there is a dark side to keeping a heavy load of unpaid bills on the books.

Every dollar you have in outstanding receivables is worth less every day. Without a clear, effective receivables management process, your cash flow suffers.

The Risks of Aging Receivables

There are a number of reasons why offering credit benefits your business. For example, it’s hard to compete if other companies in your market have more flexible credit terms. From another perspective, if you offer credit when your competitors don’t, you gain an important edge with clients. However, this edge only materializes if you find the right balance of risk versus reward.

Any time you rely on another party’s promise to pay, you run the risk of long delays before you see the cash. In some cases, the bill is never paid, and you are left holding the bag. Careful review of credit risk is helpful in reducing the likelihood of missed payments, but no credit review system is foolproof.

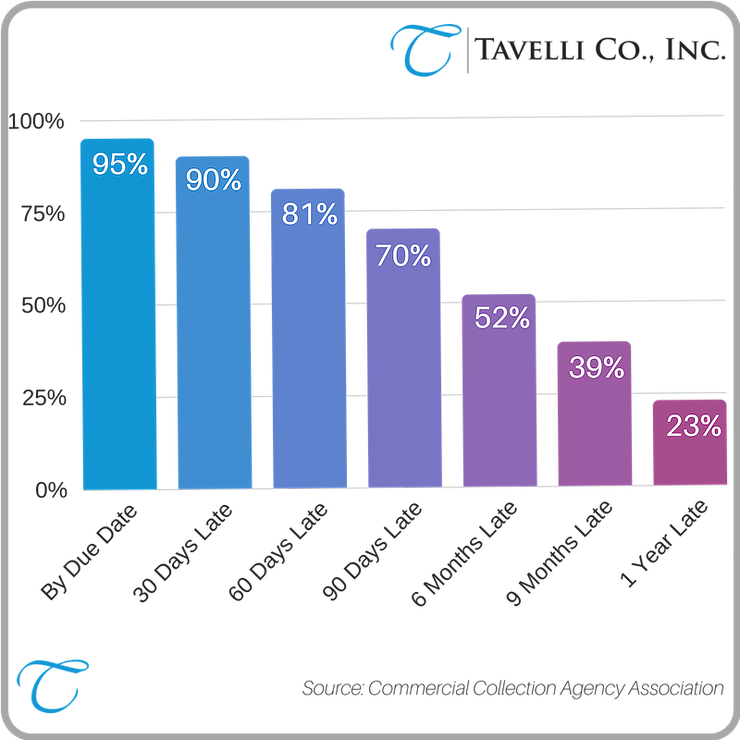

The more time that passes between delivering your product or services and collecting payment, the less likely it is that clients will come through. In fact, industry researchers have determined that once your receivables are past 90 days old, you will only collect a fraction of the total amount due. Below is a sample chart from the Commercial Collection Agency Association estimating how your receivables decline as they age.

The time value of money contributes to the on-going decrease in value of your outstanding receivables. When funds are in your customers’ hands instead of your own, you lose the opportunity to earn interest and invest in your business. At the same time, prices gradually creep up. This erodes the purchasing power of every outstanding dollar.

Finally, there is a cost associated with administration of your receivables management department. The resources you invest in recovering outstanding receivables diminish the value of those debts, so don’t spend good money chasing after bad money.

Increasing the Success With a Better Receivables Management Process

If you offer credit, your receivables management process can be a defining factor in the success or failure of your business. It is critical to design and implement a process that keeps clients current, and includes proactive intervention by a representative at the first sign of things going sideways. This ensures that accounts are settled well before the 90-day danger zone.

Keep in mind that simply following up with customers to get bills paid isn’t enough. Your receivables staff has to find balance between protecting customer relationships and settling debts.

Businesses of every size have determined that partnering with specialized receivables management firms to handle this process is a win/win solution. High-quality collections firms have the experience and expertise necessary to manage receivables efficiently and effectively without risking your relationships with your clients. Tavelli Co. is a leader in this space.

Call us today at (707) 509-5565 or visit our website to see if our organizations would be a good fit. Be sure to ask us about our early-out programs, which are a great way for you to rest assured that you are not sending accounts to us too early or late in your process. If an account pays early you get our reduced rates, if not it continues on to collection. This way you can spend less time chasing down payments and more time focusing on what you do best – growing your business!

Tavelli Co., Inc. has over 40 years of unparalleled experience in the debt collection and receivables management industry. Our mission is to achieve the right balance between getting clients paid and being empathetic to debtor circumstances, through implementing innovative practices, hiring experienced people, and improving business decisions through analytics. We provide peace of mind to all involved by collecting money with no complaints. Tavelli Co., Inc. takes the time to carefully listen to your customers and share their feedback with you through meaningful data and transparent communication, so you have access to the information you need to make quality decisions and improve your processes in the future. Contact us today and let the debt collection experts at Tavelli Co., Inc. help you set your business up for success.

IMPORTANT: Information provided by Tavelli Co., Inc., any employees of Tavelli Co., Inc., or its subsidiaries is not intended as legal advice and may not be used as legal advice. It is not intended to be a full and exhaustive explanation of the law in any area, nor should it be used to replace the advice of your own legal counsel.